Started a business alliance with Partisia.

Digital Platformer, Inc. has entered into a partnership with Partisia to develop fintech applications focused on financial security and privacy protection.

For more information, please see the press release.

Digital Platformer and Partisia enter into a business partnership to build fintech applications focused on financial security and privacy protection issues.

Digital Platformer K.K. (Headquartered in Chiyoda-ku, Tokyo; Kazutaka Matsuda, CEO; hereinafter referred to as Digital Platformer) and Partisia (Headquartered in Aarhus, Denmark; Kurt Nielsen, CEO; hereinafter referred to as Partisia) have entered into a business alliance to develop FinTech applications focused on financial security and privacy protection, (Headquarters: Tokyo, Japan, CEO: Kazutaka Matsuda, “Digital Platformer”) has entered into a business alliance with Partisia (Headquarters: Aarhus, Denmark, CEO: Kurt Nielsen, “Partisia”) to develop fintech applications focused on financial security and privacy protection.

Outline of Business Alliance

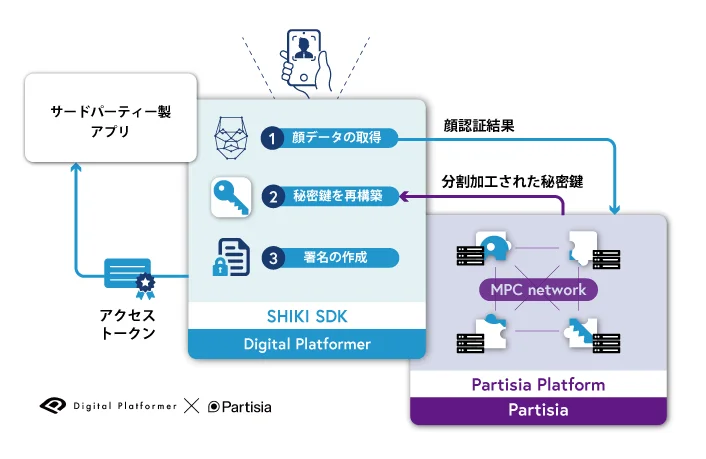

Partisia is a global pioneer in advanced encryption technology with Secure Multiparty Computation (MPC) solutions that guarantee commercial-grade privacy protection. By integrating the expertise of Digital Platformer with a focus on distributed identity (DID/VC (*Note 2)) solutions, we will develop fintech solutions that not only provide a confidential and transparent environment for transaction data and privacy protection in real time, but also enable the prediction of financial fraud through behavioral analysis and other means, and comply with trust regulations. We will also develop fintech solutions that are compliant with trust regulations.

Kazutaka Matsuda, Chief Executive Officer, Digital Platformer, Inc.

Partisia is a leading MPC startup from Aarhus University (Denmark), the world’s leading university in cryptography.Digital Platformer is a two-part company with two missions: to reduce the cost and time of money transfer to zero and to spread the DID and VC infrastructure around the world. Based on its mission, Digital Platformer provides stablecoin and ID infrastructure. Until now, improving usability and enhancing security, such as blockchain private key management, have been important issues in the deployment of the DID/VC infrastructure. We expect to solve these issues through this partnership with Partisia. Through this partnership, we hope to further strengthen our position as a top player in DID/VC and further expand our business to Europe and other countries.

Kurt Nielsen, Chief Executive Officer Partner, Partsia

Financial fraud today is becoming more sophisticated on a global scale, and despite the fact that the criminal tactics are intentionally committed through multiple banks, the authorities’ regulations require each bank to detect and detect fraud individually. Since there is a limit to what individual financial institutions can do to detect financial fraud involving multiple banks, it is important for each bank to cooperate with each other to prevent fraud by comprehensively understanding transactions and detecting anomalies. This alliance brings together the knowledge of Japan and Europe to solve the problem of financial fraud.

Partisia, Chief Privacy Officer, Mark Medum Bundgard

Our initiative is a breakthrough for the financial industry, allowing banks to not only detect fraud in real time, but also to predict possible future fraudulent activity. This will save huge amounts of time and money in security.

Balancing Innovation and Security Measures in Digital Finance

The Japanese government has positioned “fintech” as part of its growth strategy and is focusing on creating an environment for innovative financial services. Particular emphasis is placed on electronic payments, handling of cryptographic assets, and protection of personal information. The introduction of more secure and mobile stable coins (e.g., electronic payment instruments) using DID/VC with blockchain technology is now possible under the revised Wage Settlement Act, which went into effect in June 2023.

This rapid development of digital finance has brought tremendous convenience to the financial market, but at the same time, there are security issues, fraud, and invasion of privacy that must be balanced with consumer protection and the financial system.

Financial fraud detection enabled by privacy protection and transparency

Financial fraud, which has become increasingly sophisticated in recent years, is perpetrated through banks and other financial institutions, and tracking the digital trail requires not only the sender and receiver at a single bank, but also the ability to link and detect between the multiple financial institutions involved while maintaining the confidentiality of the set of transaction data used in the forgery.

Figure 1 Self-sovereign secret key completion using MPC

Partisia’s MPC and advanced encryption technologies are designed to meet the strict requirements of the EU General Data Protection Regulation (GDPR*Note 3), which came into effect in Europe in May 2018, as well as the latest AI and data regulations, and are compliant with Japan’s Personal Information Protection Act.Digital The combination of Platformer’s DID/VC and cryptocurrency issuance technology will enable the proliferation of next-generation fintech applications, including cryptocurrencies, that enhance transparency and privacy protection and enable financial fraud detection.

Note 1: Secure MPC (Secure Multiple Platform Computation) is a generic term for a procotr conducted with many participants, also known as secret multiparty computation, or multiparty computation (MPC), secret computation, or privacy-preserving computation. It uses cryptographic methods to mutually protect the privacy of the participants.

Note 2: DID/VC (Decentralized Identifier/Verifiable Credential) The combination of DID (Decentralized Identifier) and VC (Verifiable Digital Credential) ensures that the information has not been tampered with, and individuals can use their own digital As the owner of the identity information, the individual has more freedom to provide personal information, and the information is difficult to falsify, thus ensuring a high level of security.

*Note 3: The EU General Data Protection Regulation is a framework for the protection of personal data established by the European Parliament, the European Council and the European Commission in May 2018.

About Partisia

Partisia is a leading global MPC company based in Aarhus, Denmark, with internationally renowned expert members in advanced cryptographic software and business development. Partisia’s activities have been supported by the acquisition of Sepior by Blockdaemon and the Swiss Foundation Partisia. Sepior, and the Partisia Blockchain Foundation, a Swiss foundation.

About Digital Platformer, Inc.

Digital Platformer is an innovative fintech company that has been providing blockchain technology-based digital regional promotion notes and decentralized ID and digital regional currency issuance platforms to local governments and businesses since its founding in 2020. 2024 will see Japan’s first deposit-based stable coin issuance with a regional bank. We are working to develop a new platform utilizing consortium-type blockchain that meets the diverse needs of local governments and business corporations.